BACO TECH PROVES TO BE ESSENTIAL IN HELPING WITH PPP LOANS

In March of 2020, “business as usual” was turned on its ear. American workers were sent home and every business, rather small or large, was left with one prevailing question on their minds, “How are we going to get through this?” The government reacted quickly, extending tax filings and payments until July and offering an incredible thing most businesses only dream of, a short-term offer to cover employment costs and overhead through an SBA PPP loan program.

Business owners likely asked their CPAs to help with these calculations, but new data had to be gathered and analyzed, new forms needed to be learned, and their data with their CPA firm was likely only through 2019, when data through 2020 was required. Bankers and their banks all had different forms, interpretations, and guidance. Courses were taught, but items included or excluded in the needed calculations kept changing. Every CPA firm was inundated with new tasks that they had to accomplish that interrupted their typical workflow. Many CPA firms could offer little help.

Our client, the BaCo Group in Dallas, Texas, was easily able to help their clients. For this firm, sheltering in place didn’t alter much of their workflow. As a firm, they were utilizing an exciting new software that was developed in house. This software, now called BaCo Tech, gathers data real time every night for every client and delivers it to BaCo Group in a Living Trial Balance TM with access to the underlying details. It not only streamlines the year-end procedures for financial statement and tax return preparation, it also delivered up to date data.

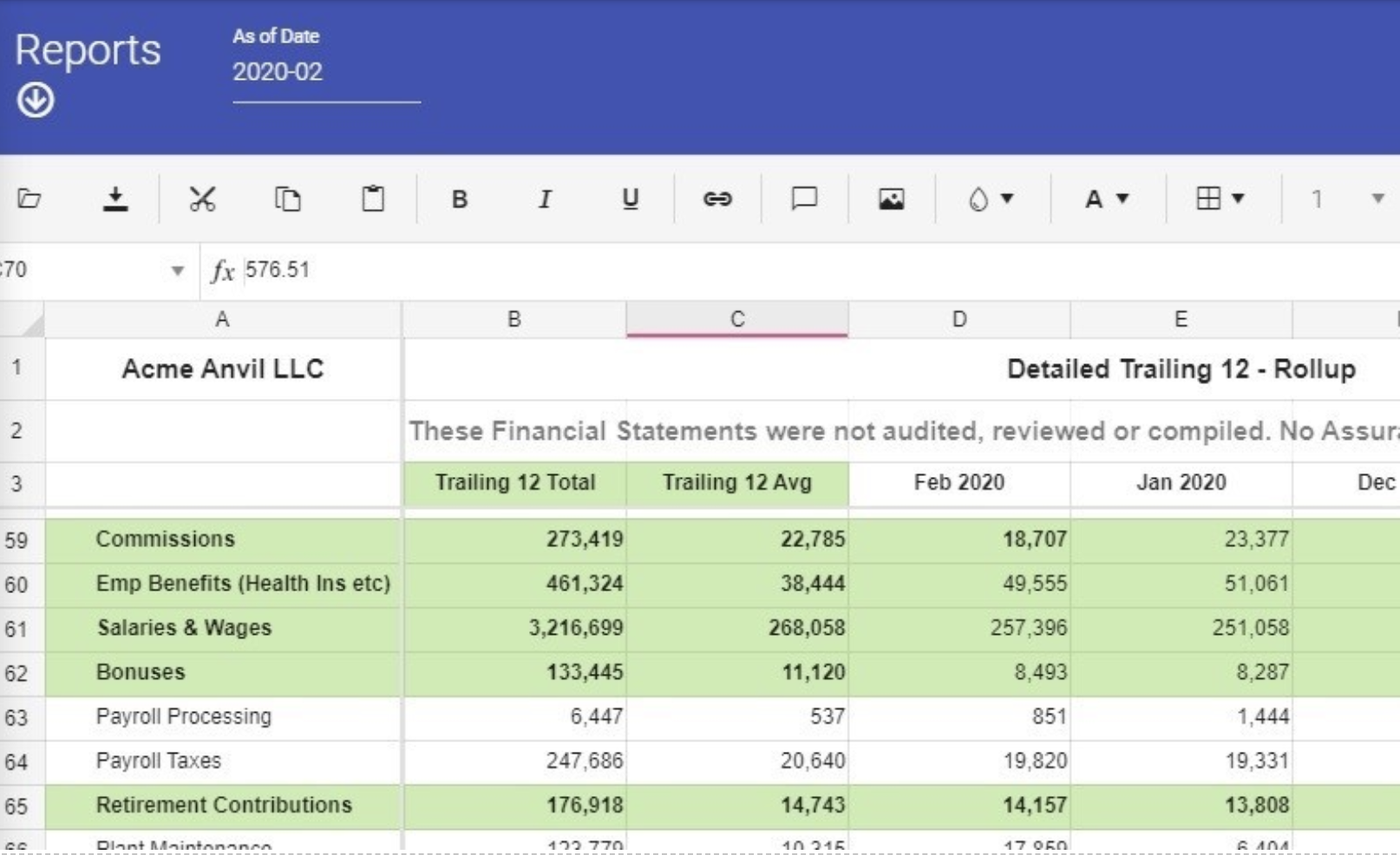

As CPAs, BaCo Group knows that business owners who truly want to be on top of their books and their businesses utilize a Trailing 12 Report, with totals and averages for every expense category from the last 12 months.

In April of 2020, the SBA required a trailing 12 average for payroll related costs for the PPP loans. BaCo Group not only had that data on hand, but they already had those categories broken out, so all they had to do was run a Detailed Trailing 12 Report, consolidated for the entities that are combined and needed to make the loan application. Since they had the details behind each transaction, they could get that information quickly and efficiently.

Of course, this is not without complications. There were a handful of complications and things that needed to be accounted for in this process.

- Compensation for any employee in this 2-month period was limited to $100,000.

- “Payroll related expenditures” included wages, health insurance benefits, retirement benefits and state taxes paid.

- Federal payroll taxes and other employment-related costs like payroll processing and workers comp were excluded.

There was no way that anyone could know in 2019 that there would be a pandemic that would require this type of calculation for every client, but BaCo Group had access to this information, so obtaining it and delivering it to the clients was simple.

After the loans were delivered, the change didn’t stop there.

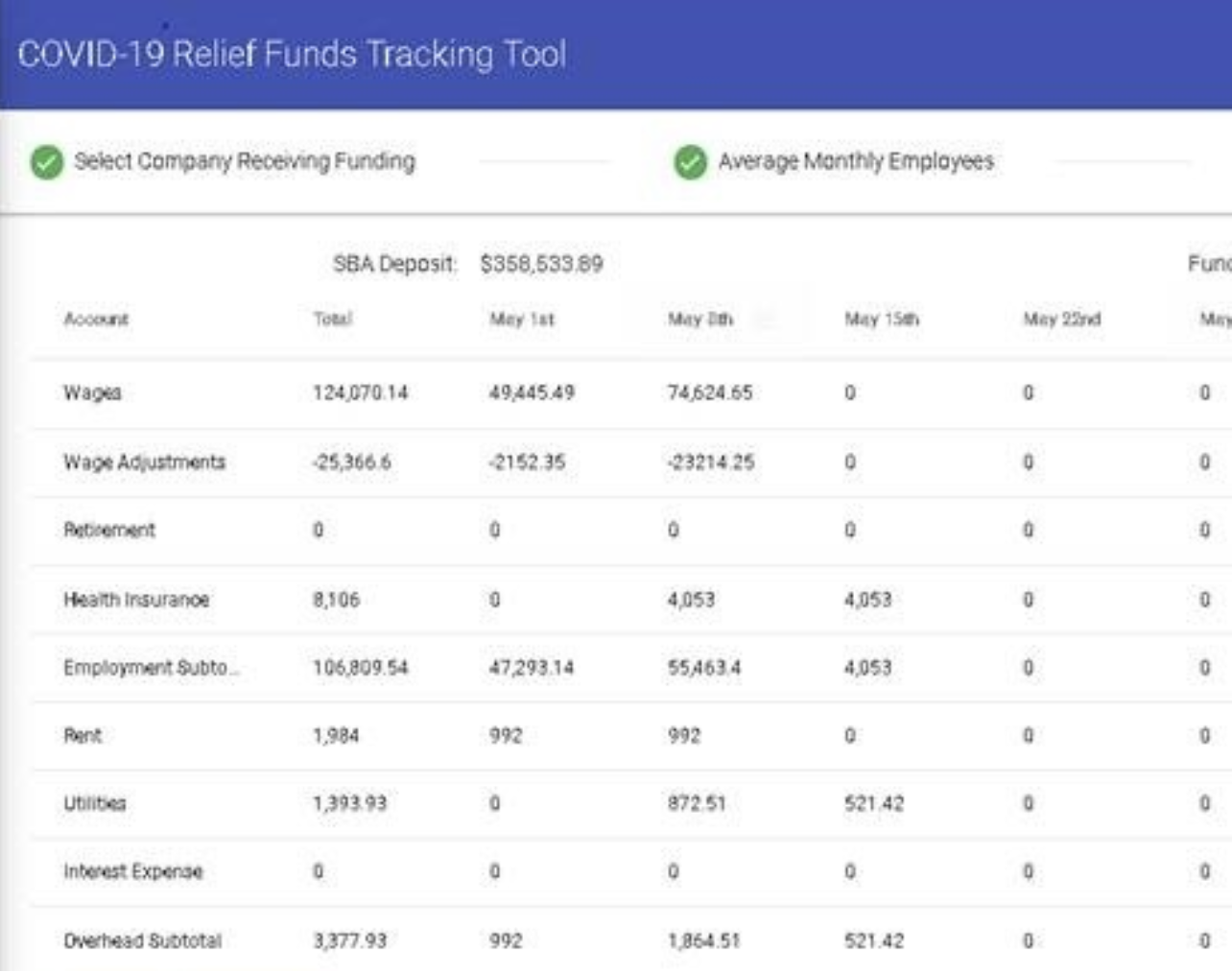

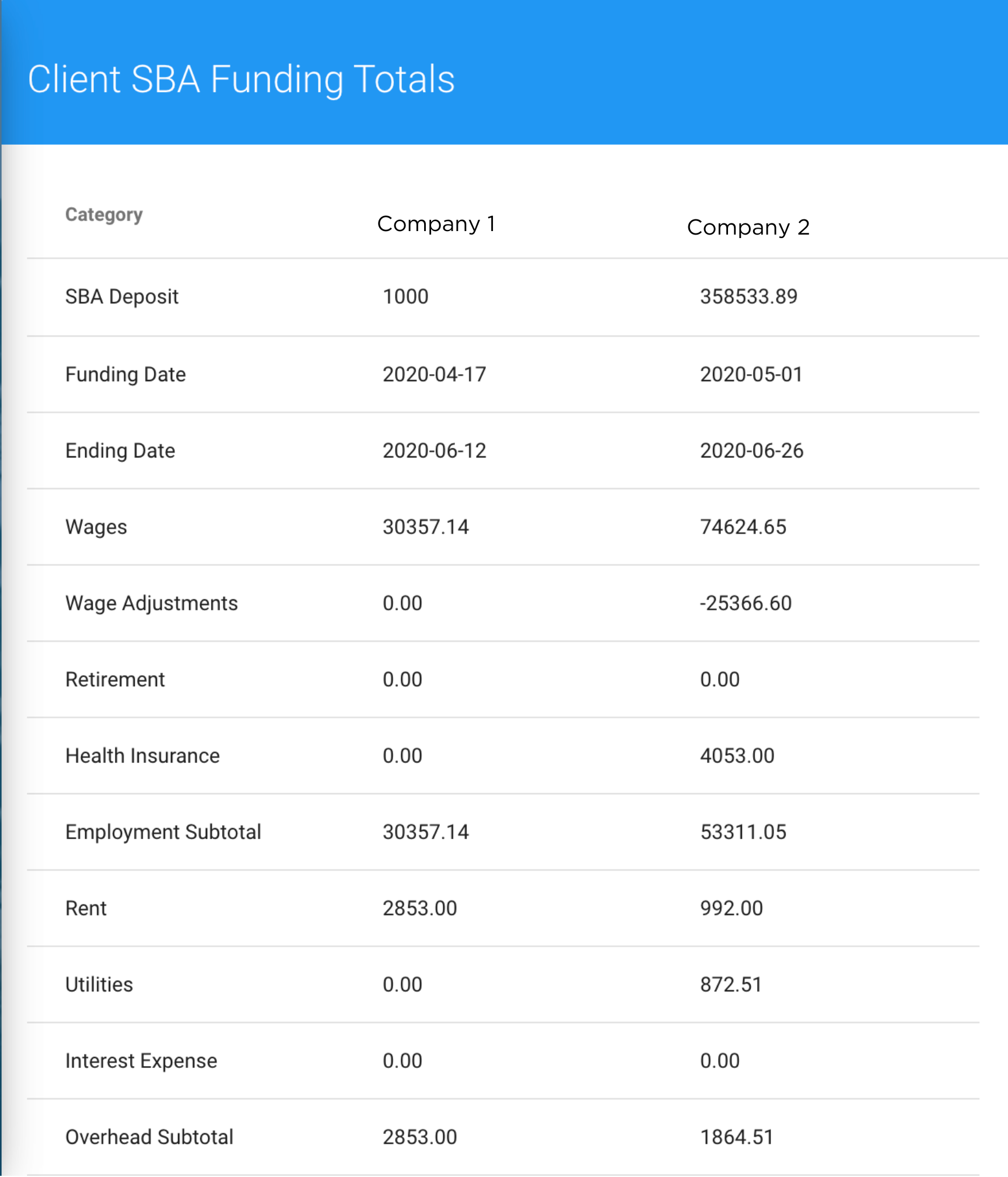

Each of these loans would need to prove that the payments they made over the next 8 weeks were in accordance with a formula that tracked the company's expenditures over an 8 week period that started the day the SBA funded their loan. Actual cash spent for payroll and occupancy related expenditures. This brought in many complications, firstly that the loan issued is for 2 months – which is 61 days – but companies had to spend that loan in 8 weeks – which is 56 days. This essentially cuts off one week of business and in that week, there could be rent payments scheduled, payroll, and other large expenses.

An already complicated process became more complicated – and there are even more nuances and difficulties than that.

Complications from PPP Loan Forgiveness

- Wages were limited to $100,000 per employee, so wages over $15,384.62 were excluded from the calculation. There are 26 pay periods per year in a bi-weekly payroll and 24 pay periods for a bi-monthly payroll, annualizing salary and limiting it to $100,000 creates different limitations as the 26 payments for a $100,000 salary paid bi-weekly are lower than 24 payments made for a $100,000 salary paid bi-monthly. The same $100,000 salary could therefore borrow more money on a bi-monthly average than a $100,000 salary could pay back on a bi-weekly basis.

- The expenses had to be paid, so health insurance expenses, retirement contributions couldn’t just be incurred, they had to be paid out, rent and utilities needed to be paid with cash

- If expenses were paid automatically, using the company credit card, nobody was sure if the SBA or their bank would look at that as a cash expenditure, their loan dollars would still technically be sitting in a bank account, waiting to be used to pay down a credit card. Since nobody was sure, business owners had better pay those expenses with a check or pay the credit card down within those 8 weeks, to show they were paid.

- The 8-week period started on the day the funds were funded, a CPA would not know when that started or when it ended. He also would not have access to the exact amount received, so he may not know the amount borrowed. He may not even be able to find it, because the owner might have been worried about recording it wrong, so they did not.

Clients of the BaCo Group did not have to worry about that because their accountant was using BaCo Tech, they only had to fill out a form to identify the deposit for the loan, their accounts used to record wages paid, and vendors they pay for utilities, rent, health insurance, mortgage, and retirement benefits. A spreadsheet was on the report they could download and calculate the limitations.

David Knedlik is the Chief Technology Officer at BaCo Tech and the co-inventor of the platform. David identified the key benefit to working on a Living Trial Balance™ vs. the standard trial balances that CPAs use.

“Every CPA is given balances to work with, typically month and year end balances. So custom reporting on these balances is impossible if they include anything other than month end balances. A living trial balance is fluid, it is a summarized report of every transaction, by account number. Because of the nuances of the law pertaining to spending, it is important to track where the money is going at a very granular level so there is time to adjust if necessary, before the spending deadline. This is impossible with normal monthly balance reporting. Because BaCo Tech integrates with our client's ERP systems, we have spending updates as they happen. This allows our CPAs to analyze burn rates and categories in real-time and provide better feedback to our clients on progress.”

“It is encouraging to the team to make these things possible for CPAs and even more so when the CPAs report back on how clients benefited from this in huge ways,” said Product Manager, Sara Renfrow. “That being said, we can’t help but think about the rest of the folks who don’t have this, but if this idea had existed before or if the clients of the firm that did not use the platform based on limitations we had put on ourselves, you can’t help but feel for them.”

At BaCo Tech, our goal is to help CPAs and their clients run better businesses no matter what season they are in. We have been thrilled with how our technology has helped both business owners and CPAs thrive in a season where many are struggling. The notion of “We Speak Accounting” is a simple one – we take the complications out the client’s hands and give the necessary data to the CPAs so they can, in turn, give their clients what they truly need: answers and help.